Alert service for world indices, commodities and Cryptos with stops and targets:

For 2 indices you choose $80/per month+ 5% PayPal fees. ( minimum 3 months subscription you will receive 1-2 alerts per week)

For 3 : $100/m " "

For 4 : $140/month. " "

*Natal chart reading: $480, ( + 5% PP ) for 1 year forecast.

*The yearly forecast report is based on technical analysis, cycles, and math: $400 for a year.

If you really want to know how do I make my forecasts and you wish to study, sign up to the "Financial Astrology course".(10 meetings, $10000.00 lot of homework! If interested will send syllabus )

Here is a link to my You Tube channel:

GMAMA~~~~~~~~~~~~~~~

You might want to click "interesting, cool" at the top of the article and of course you are welcome to leave messages, questions, whatever comes to your mind.

And don't forget to click "Like" at the top of the article!!

~~~~~~~~~~~~~~~

January 1, 2025

December 31, 2024 Tuesday

Today we have a Bayer rule, that predicts "big changes when Mercury crosses 19^♐. We also have a New Moon today, so I will start a new article when market closes.

Let's see how did the USA behave yesterday?

Bulls and bears almost equal..

All happened as per the statistics posted yesterday. For today a reversal is expected. So let's look at the numbers and the planets. It is a day ruled by Mars, in opposition Pluto and trine the NNode. Venus is also a co- ruler, and it is at 26♒56; it is a Cancer degree, at 10:15 am it moves into 27*, which is a LEO degree, so I will wait and see if markets will reverse then.

31.12.2024 0:26:35 9°43'41"Cap Conjunction Sun

31.12.2024 9:02:27 14°28'15"Cap Sextile Saturn

~~~~~~~~~~~

BTC: 60 MIN: Fell to 91300

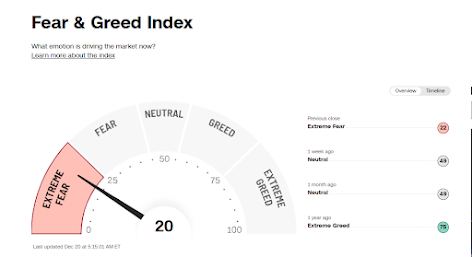

Cryptos fear and greed index: at 48;

USA indices fear and greed:

Nasdaq: Gann targets given below 19470; on the short side, reached, now, holding that level, a reversal should come. The statistics from 1999 show for today, that 9 times it went up and 8 times down, so that is pretty much like throwing the dice. Pls. sign up for the yearly forecasts, to see into the future! Below 19470 next Gann level is 19414-357.

~~~~~~~~~~~

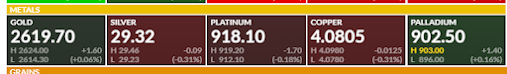

Silver shows some weakness, probably will go down till mid January... But again.. forecasts are available !

Buffett is buying like crazy ! ~~~~~~~~~~~~~~~~

More later.

TA35: stop 2372- target 2379-84- 89- 94-97

BTC video:

TA35 : topped at 2398.70 and closed 2394.96

~~~~~~~~~~~~~~~

Tomorrow we have trade as usual, only the Moon will be conjunct Pluto ; 60^ to Neptune and 135^ to Jupiter. Not the best possible positions...

Support is still 2388- 94 - Target 97-2401.

December 30, 2024 Monday

Two more days are left of year 2024. It is a day ruled by the Moon and Mercury. The Moon just moved into Capricorn- 30^ minor aspect to Pluto; Moon 90^Nodes; Mercury is at 17♐;135^ to Mars;

Time tunnel: today is 55 days from 11/5 low. ( S&P).

~~~~~~~~~~~~~~~~~~~~~

News in the world: R.I.P. Jimmy Carter, died at age 100; under his presidency, 3/16/1979, the peace treaty between Israel and Egypt was signed, that is still keeping. May he rest in peace.

As posted in yesterday's post, Netanyahu underwent a prostate operation, which went well.

~~~~~~~~~~~~~~~~~~

Futures are red, but this will change when markets will open

BTC: check out the statistics posted on 12/28; trade range now is 93500-94500.IMHO

~~~~~~~~~~~~~~~~~

The strongest planet today is Saturn; while Ceres and the Moon are OOB

SPY statistics :

TA35: trade range 2364-73-79-84-88.

Teva in Israel , the support is at 7600- here is past statistics for Dec. and January

As per TS and my forecast, we saw the last top, and now it'll go down till June 10-15

~~~~~~~~~~~~~~

BTC AND RIPPLE compared to the ETH:

Crypto fear and greed index - it is going towards fear, so buying opportunities are showing up

~~~~~~~~~~~

Terrible plane crash, 179 died, 2 survived... Dec. 29, 9:03 am; Jupiter ( aviation, big planes) 180 to Moon + Merc ( accidents) in SAG ( air) fire sign.

no wonder BA shares decline in premarket !

~~~~~~~~~~~~~~~~~~~

Another big crash occurred, also under Moon+Mercury conjunction, on Aug 6, 1997

December 29, 2024 Sunday

I ran the Nasdaq statistics, to see how it behaved previously: it shows more a decline in the rest of the month, than a rally. But you must keep in mind 2 things: since 1500-1600~ ish years, we didn't have the same planetary positions as now and 2) in the past we didn't have AI, Quantum, Nuclear and other branches that rallied so much , or better say, just started to rally.

My last alert was on Nov 19- stop was 19020; now we can raise it to 19700; if above 19800 we will see new highs.

~~~~~~~~~~~~~~~~~~~~~~

8:10 am

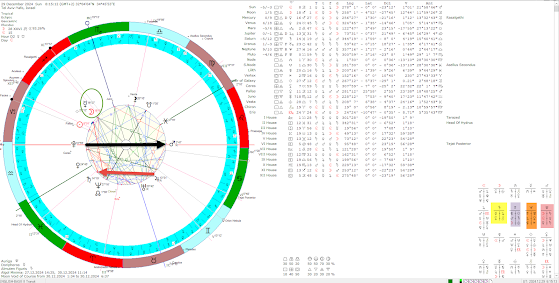

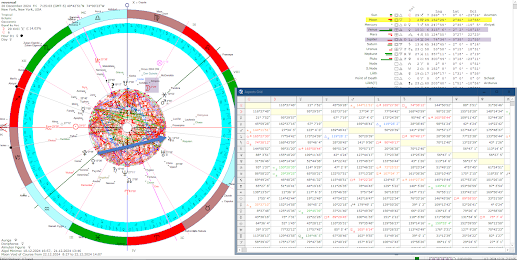

the sky today: we are under the energies of the Sun and Uranus; they are not in aspect. The Moon conjunct Mercury ( high volatility)in SAG; Mars is still in opposition Pluto; and Jupiter squares Saturn. Check out the lasting midpoints at the right. Saturn at Me/Ju MP ~ that can block rallies. ( in Ebertine's midpoints book there are no explanations on trades; this is my view about this MP. )

Uranus ( unforeseen events) is at the MP of Mars(weapon, war, fights) and Saturn( government) .

Ebertine wrote: " Extraordinary and unusual powers of resistance, the ability to give or take everything under provocation the inclination to apply brute force, a test of nervous strength intervention of higher power or providence, a sudden illness, separation or case of death."

To see what

effect this position had , we better check the past.. here are previous times: the Nasdaq rallied after this position.

In the Helio centric chart, a date to look out, or mark in the calendar is Jan 3rd, Venus will conjunct Uranus in Taurus ! Venus will conjunct Uranus on more time is 2025- and that will mark the end of 7 years' cycle of Uranus in this sign; previously Uranus was in Taurus 84 years years ago, between 1934- April 17, 1942; not many shares traded then, to be able to compare, but we had the WWII....Uranus stays 7 years in a sign, doesn't hat remind us of Joseph's dream, from the Bible?

Counting from when Uranus was in Taurus, the low 6190; further Gann targets are:

Gann sq low 6190 in 2018

Gann targets 19470-19530- 19588-

19704 19762- 19820-19878-19930-

20290- -20233-20350- -20650

~~~~~~~~~~~~~~~~~~~~~~~~~

Joseph's dreams in the Bible( astrology is based on the Bible stories- so the 7 years of Uranus is here:

The seven good years appear later in the story of Joseph, in Genesis 41, when he interprets Pharaoh's dreams. These dreams and their interpretation establish Joseph as a divinely gifted leader and pave the way for his rise to power in Egypt.

Pharaoh’s Dreams (Genesis 41:1-7):

Pharaoh dreams of:

Seven fat, healthy cows emerging from the Nile, followed by seven thin, gaunt cows that eat the healthy ones.

Seven heads of plump, ripe grain, followed by seven thin, scorched heads of grain that swallow up the healthy ones.

Joseph’s Interpretation (Genesis 41:25-32):

Joseph explains that the two dreams convey the same message:

The seven good cows and seven good heads of grain represent seven years of abundance in Egypt.

The seven thin cows and seven scorched heads of grain represent seven years of famine that will follow.

Joseph emphasizes that the repetition of the dream means the events are firmly decided by God and will happen soon.

Significance of the Seven Good Years:

Preparation:

The seven good years are a time to store surplus food to prepare for the coming famine. This foresight enables Egypt to survive the famine and become a refuge for neighboring nations, including Joseph’s family.

Providence:

The good years reflect God’s blessing and provision, while the famine underscores the importance of wise stewardship of resources.

Joseph’s Leadership:

During these years, Joseph, appointed by Pharaoh as second-in-command, organizes a systematic collection of grain, showing his administrative skill and obedience to God’s plan.

Themes and Lessons:

God’s Control Over History:

The cycles of abundance and famine show that God governs all aspects of life, including prosperity and adversity.

Wisdom in Planning:

Joseph’s management of the seven good years teaches the value of preparing for the future, especially during times of prosperity.

Redemption and Reconciliation:

The abundance allows Joseph to reunite with his family when they come to Egypt seeking food, fulfilling God’s promise to preserve the lineage of Israel.

The seven good years serve as a pivotal chapter in the narrative, illustrating divine provision, human responsibility, and the unfolding of God’s redemptive plan.

~~~~~~~~~~~~~

No. 7 is a sacred no. it is mentioned in the Bible 700 times ! Also the multiples of 7 , in trade are most important. 7 is ruled by Neptune(religion and the South Node)

The number 7 is mentioned over 700 times in the Bible, making it one of the most significant and symbolic numbers in Scripture. Its frequent use highlights its association with completion, perfection, and divine order. Here are some examples and contexts where the number 7 is mentioned:

1. Creation and Rest:

Genesis 2:2-3: God created the world in six days and rested on the seventh day, sanctifying it as holy.

2. The Flood:

Genesis 7:2-4: Noah is instructed to take animals into the ark in pairs, with clean animals taken in groups of seven. The floodwaters came after seven days.

3. Abrahamic Covenant:

Genesis 21:28-30: Abraham gives seven lambs to Abimelech as a witness to their covenant.

4. Feasts and Sacrifices:

Leviticus 23: The Feast of Tabernacles lasts seven days.

Leviticus 4:6: The priest sprinkles the blood of a sin offering seven times before the Lord.

5. Jericho:

Joshua 6:4-15: The Israelites marched around Jericho for seven days, with seven priests blowing seven trumpets on the seventh day.

6. Prophecies and Visions:

Daniel 9:24-27: The prophecy of the seventy sevens (70 weeks) outlines God's plan for Israel.

Revelation 1-3: John sees seven churches, seven spirits, seven seals, seven trumpets, seven bowls, and other symbolic uses of seven.

7. Forgiveness:

Matthew 18:21-22: Jesus tells Peter to forgive "not seven times, but seventy-seven times," emphasizing limitless forgiveness.

Significance of 7:

Divine Completion: Represents God's work and order, as seen in the seven days of creation.

Spiritual Perfection: Often associated with spiritual fulfillment and holiness.

Covenants and Promises: Used in many of God's covenants, reinforcing their divine nature.

Prophetic Meaning: Central in eschatological (end-times) contexts, especially in the Book of Revelation.

The repeated use of 7 demonstrates its symbolic importance throughout Scripture, emphasizing God's perfection, authority, and the completeness of His plans.

~~~~~~~~~~~~~~~~~~

News about Netanyahu: medical check up last Wednesday - he must undergo prostate operation; note' that tr. Mars will be in H8 till late April !

9:55 pm: the surgery went well. However, that tr.Uranus, 150^ to his Libra stellium, in H6, is not a good sign for the future. Also tr. Mars will be in his H8 till mid April.

December 28, 2024 Saturday

Yesterday in the USA: we saw some weakness

YTD: best performers were :

these share were not from the biggest market caps.. but small ones.

probably you think, NOW you are telling us??? lol.. well, we can learn from the past.

I hold for a long time NNDM, waiting to break up, above 3.725; then it might go to 9-13-14...

TSLA: Statistics for Dec and first days in Jan. Check out yesterday's post, fell way below the stop !

Major support level is between 373-380 - seems in February it will correct down.

The same statistics can be made for anything you trad, for a years ahead.. Pls. sing up for the forecasts... $400 for a year with quarterly updates.

~~~~~~~~~~~~~~~~~~~~~

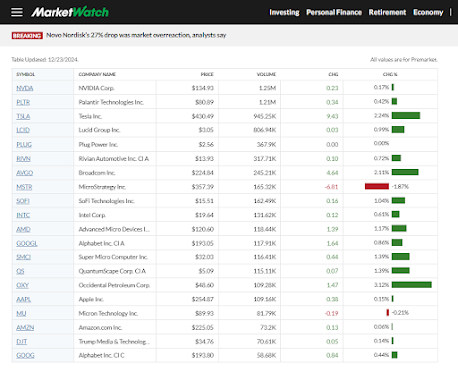

Check out the stops given yesterday, except for AAPL, all alerts were triggered, and fell.

~~~~~~~~~~~~~~~

BTC: STATS: Seems it'll try to go up till Jan 3-4, and then correct down.

December 27, 2024 Friday

Yesterday in the USA:

the Banks joined the rally:

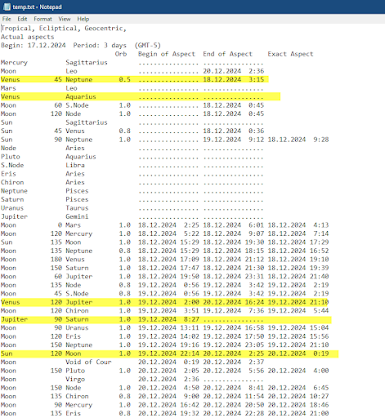

News in the sky, is any..

The Moon 90^ Venus and 180 Uranus; Venus ( ruler of the day) is at 22*!

Here is the calendar for GMT:00

But, I like ZET format better: I use here 0.5-1 deg orb

compared to yesterday, not much difference...so trend continues.

upcoming announcements:

Asia and the Far East: mostly rallies:

ES: made a new high at 107.50; and declined.. it is still a long.

QQQ: REACHED THE TARGET 531, GIVEN.

BTC: is still Neutral, stop 96000

ETH: the fear and greed shows strong sell, stop 3360 .

NNDM: is in a big rally wince Nov. 18 !!! targets= former tops. even if it doesn't go to 16, the Jupiter synodic cycle does point to a rally. Now at $2.68

AVGO: targets are still waiting to be hit.

MSTR: consolidated for a long time, it is interesting to see, that it made 7 times the deep:

AMZN: makes lower highs, stop 226;

AAPL : stop was 241-44 on 12/4 - scroll down, now it made a new ATH at 260; new stop = 253

META: stop was 612, topped at 637 on 12/11 ( Fib count start from there) and fell to 584, now at 603; only above 605-613 will be a long .

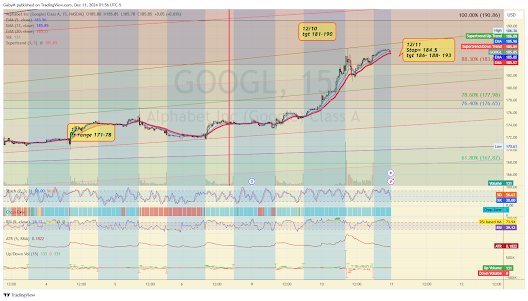

GOOGL: stop on 12/11 was 184.5 - topped at 201 ( on 12/17) now at 195;60, stop moves to 193 long if above.

NFLX: stop = 920

NVDA: all given targets reached, stop now 138.72

TSLA: also reached all give targets, topped on 12/18; stop now 454.45

Will they continue to go higher? subscribe to the forecast, you'll see.

~~~~~~~~~~~~~~~~

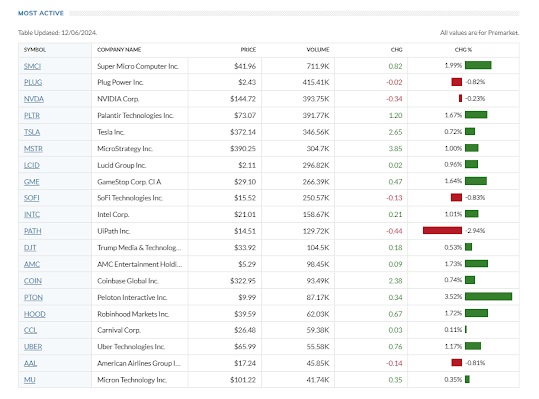

Biggest volume yesterday: SOUN and RGTI are the ones I would follow/buy.

SOUN is a very young share, cannot be analyzed with astro cycles.. but 28 is stop.

RGTI - is from the "quantum" group... so..

~~~~~~~~~~~~~~~

FRANKFURT, Germany (AP) — German President Frank-Walter Steinmeier on Friday ordered parliament dissolved and set new elections for Feb. 23 in the wake of the collapse of Chancellor Olaf Scholz’s governing coalition.

Scholz lost a confidence vote on Dec. 16 and leads a minority government after his unpopular and notoriously rancorous three-party coalition collapsed on Nov. 6 when he fired his finance minister in a dispute over how to revitalize Germany’s stagnant economy.

Leaders of several major parties then agreed that a parliamentary election should be held on Feb. 23, seven months earlier than originally planned.

Since the post-World War II constitution doesn’t allow the Bundestag to dissolve itself, it was up to Steinmeier to decide whether to dissolve parliament and call an election. He had 21 days to make that decision. Once parliament is dissolved, the election must be held within 60 days.

Germany: using the date from Bill Meridian's book, Sun at 1.56 Gemini; gets a trine from tr. Pluto; while Venus, ruler of the MC(gov) a conjunction from Jupiter..DAX "

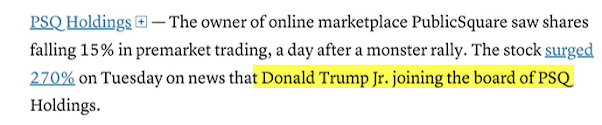

as a result : short SOXX: cycles worked well ! To see into the future, pls. sign up for the forecast! $126 for 3 months/ $400 /year. COSTCO: BIRD FLU & SALMONELLA OUTBREAK IN EGGS

December 26, 2024 Thursday Today we are under the energies of Jupiter and the Sun.

Jupiter is still weak in ♊, it is in exact opposition Mercury, and squares Saturn. While the Sun, 4- 5♑ is breaking off from a disharmonious aspect to Mars, the Moon, for intraday trades, is still in the sign of the Money ( ♏) the only asp. she makes is :

26.12.2024 14:30:24 14°07'50"Sco Trine Saturn ~ support/resistance time.

In the table below we can see there is a Mercury (grains, transportation, news) square Saturn(blocks everything) - so translating that to the market, check those areas.

Using this square to TA35 ( but you can count the same for anything , how? I teach that in my Financial Astrology course ) the expiry today should be above 2383.7. but, it just a wild guess, there is no way to know how will the big guys expire today's monthly options.. ~~~~~~~~~~~~~~

Today most of Europe doesn't trade; in the USA : Fed.ann. before the opening

after the close:

Nasdaq future is green, probably we will see new highs here

9:20 am ASIA TRADES NOW: let's check them:

These are up: but none made a new high !! just correcting previous falls.

DAX: Gann square root fans: pick a low and a major high, and draw - it is now supported by the fan. The problem is, that one can loose a lot or gain a lot trading the DAX... so better use the 60 min or 30 min chart.. It is closed today, but here is the last alert I gave: we are still short below 20315. TA35: expired at 2377.59 - 6 points lower than I thought. Now the trade range is 2375-84 Cryptos by market cap:

TA Banks - are pulling the markets down MSTR: IMHO !!!! even is it corrects down till year end, it will rise in January 2025BTC : DAILY : All these can change in a blink of the eye ~~~~~~~~~~~~

NIO : buy back tgt 4.9- 5.1

~~~~~~~~~~~~~~~~~~~~

December 25, 2024 Wednesday

I never saw this!! 100% Bulls !! ~ early close, Merry Christmas !!

Today only a few countries trade, all are closed for celebrations. May they have a peaceful day! We here got a siren at 4:23 am - probably a rocket from the Houthis, damn them. I turned on my other side and went back to sleep.

~~~~~~~~~~~~~~~~~~

Some shares I follow: in the QUANTUM field:

This is a new field, it will go higher..with Uranus in ♊

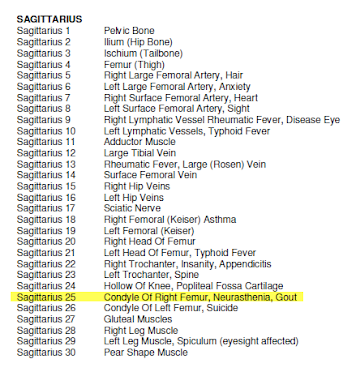

The sky today: Sun at 3 Cap.- 4* = medically it rules Cutaneous

Nerves Of Upper Leg, Eyesight

The Moon is now at 29♎ = Right

Ureter, Bronchitis

Libra30 Left Ureter

25.12.2024 10:06:06 0°00'00"Sco <<<

25.12.2024 11:51:19 0°52'00"Sco Square Pluto

25.12.2024 17:44:09 3°46'38"Sco Square Mars

25.12.2024 18:59:27 4°23'58"Sco Sextile Sun

~~~~~~~~~~~~~~~~~~

Mercury 11♐60;Adductor

Muscle

Sagittarius12 Large Tibial Vein

Venus 20♒23 = Aquarius20

Cord

Aquarius21 Nervous System Of The Spinal

Cord

Mars 3 ♌52 = Right

Artery

~~~~~~~~~~~~~~

If you have a planet at the above degrees, they will be triggered. - better see a doctor..

~~~~~~~~~~~~~~~~~~~~~

To my reader from Holland: here is the AEX: as long as it is above 855 it's a long.( in green the Gann square root lines. ) This is the monthly chart; like other Europe indices, this too topped on 7/15, and has been falling, since. in the daily chart 873 is the stop. All my stops and targets are based on planetary positions.

BTC :

Here is a very interesting site, if you trade the BTC, you must know everything about

Michael Saylor; I analyzed his chart and wrote a lot below...

~~~~~~~~~~

Banks were weak in the last month ! Should we sound the alarm? it is now 9:10; market opens in 35 min. The close in TA35: was 2402.75; the arbitrage is positive, planets support at 2402; then, as the USA, we should rally to 2404-2412-14-20-23-27.

I have no positions. Simply, because yesterday the index could not go above 2404- which is the Sun Line; so until it is below, I am waiting, 10:00 am bought C 2400 let's see if C Dec 2400 reaches 770-950 ? low today was 450

~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~

TA35: 1 min chart; this is how I follow the market and trade options... 2404 is stop for long, while 2413=14 is target... note, that I use geo ( yellow) AND helio ( blue) positions!

I just realized, we have an opposition today between the Lilith and Chiron ... I was searching the news, and an airplane crashed in Russia; 30 survived, 42 dead... I wonder who was on the plane, targeted by a flock of birds.... News say, it clashed with birds... hmmm Justin Trudeau is 53 years old today: Solar return chart on his natal: S.R. Pluto in trine his Saturn - that is a sign for a culmination and fall IMHO ; also S.R. Mars - Neptune aspect While in his Lunar return chart Venus is 0^ to natal Venus ( H10) and Saturn squares N Merc (H1) ~ TA35: 2310 was top, and then the banks pulled the markets down. closed at 2394; Probably tomorrow it will correct up.

December 24, 2024 Tuesday

Yesterday in the USA:

it was again the Technology group, that picked up the rally.

Still in "Fear " zone - buying time..

and of course, the MAG's 7:

Pls. subscribe to the forecasts, to see how long more the rally goes on.

~~~~~~~~

Today the world celebrates X-mas; early close, and low volume is expected.

In the sky: we still have the Moon in ♎; and the main event is the square between Jupiter and Saturn, as I pointed out in previous posts...

Today we are ruled by Mars and Saturn; there is no aspect between them.

~~~~~~~~~~~

ETH/USD: ALTHOUGH made a rise, but it still below the expected target.

Trump said yesterday, that Elon Musk cannot be President, because he was not born in the USA. Well, Obama wasn't either... nevertheless...

~~~~~~~~~~~~~~~~~~~~

Premarket movers:

TEVA Israel: looking back caught all the spikes and lows; for the future forecast, pls. subscribe. $126 only for 3 months !

Nifty is getting weaker...

NIO: seems it will rise till Dec. 30th.. I put a note in the calendar to check it..

PLTR: stop 76.60 - 80 !!! be extremely careful ! if below, target = 64 !

Palantir's business is growing quickly, but Thiel's sales say something about the stock.

Peter Thiel is best known as one of the co-founders of PayPal and an early investor in Meta Platforms, then known as Facebook. After leaving PayPal, he co-founded another company, Palantir Technologies (PLTR 2.09%), where he serves as chairman. Thiel sold over $1 billion worth of Palantir stock over the last few days of September and the first day of October, according to Securities and Exchange Commission (SEC) filings. Those sales came after the company officially joined the S&P 500 on Sept. 23. Thiel also shed about $400 million worth of Palantir stock earlier this year.

Thiel's sales were executed automatically as part of the 10b5-1 plan adopted in May. That plan automatically sells Thiel's shares upon reaching certain criteria, effectively reducing the influence of insider information on the selling decision. Thiel has now exhausted the authorization through Dec. 31 of next year.

~~~~~~~~~~~~

Tomorrow we will open with the Moon at 29♎59; and after a few minutes she will enter Scorpio. Sun 150^ Mars exactly, Mercury at 12,Jupiter at 13, Saturn at 14 degrees in diff signs. therefore, TA35: stop = 2397- target 2404-2413-14 if still above.. then even 2423-27.

~~~~~~~~~~~~~~~~

December 23, 2024 Monday

When we are in " Fear " area, time to buy..

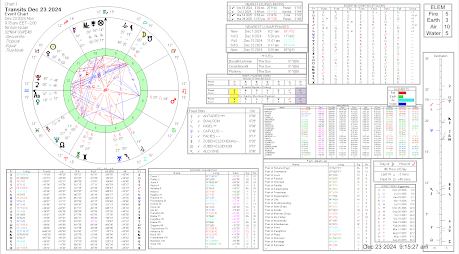

The sky now: the strongest is still Venus, while the weakest is the Sun

The Moon in Libra is departing from a bad conjunction to the South Node. Mercury is still in detriment ( in SAG).

Listening to

Larry Williams: he speaks about BOTZ, I made the analysis, and I am show ing you a piece of it.. pls. subscribe to the yearly forecast to see how and when it turn.

BOTZ ETF: Gann angles:

For intraday trade only, we look at the Moon: today from ♎ GMT+2

23.12.2024 0:18:00 1°34'06"Lib Square Sun

23.12.2024 5:59:18 4°22'21"Lib Sextile Mars

23.12.2024 18:21:55 10°27'32"Lib Sextile Mercury

Half day trade in the USA !

24.12.2024 1:51:08 14°08'08"Lib Trine Jupiter

24.12.2024 12:43:45 19°28'35"Lib Trine Venus

25.12.2024 = no trade in most of the countries.

26.12.2024 Moon is already in Scorpio; - approaching the Sun, thus fading in light,

26.12.2024 14:30:24 14°07'50"Sco Trine Saturn

27.12.2024 7:07:59 22°31'16"Sco Square Venus

27.12.2024 9:33:55 23°45'27"Sco Opposition Uranus

27.12.2024 16:23:39 27°14'32"Sco Trine Neptune

27.12.2024 21:46:13 0°00'00"Sgr <<<

27.12.2024 23:35:53 0°56'25"Sgr Sextile Pluto

9:50 market opened; at 2396.12 - now the support is at 2394- target 2413.

we got a low at 2390, and when the Sun squared the Nodes , a reversal and up

listen to the bells, when they ring, they bring a reversal... ( in Europe they ring at noon)

~~~~~~~~~~~~~~~~

NVDA: premarket is up:

1:35pm:

Moon 135^Uranus - a harsh move must come - to one of the directions. Last low was 1989.36 - Support is at 2388.35

we reached 240 min from the top, a reversal now ...

Nifty closed above the stop- made higher lows, we are long

TA35: WE GOT A BREAK OUT ! TARGET 2392 - went to 2394 and reversed. 2384 reached. Closed 2388.18; tomorrow stop 2384- target is still 94-2401

~~~~~~~~~~

December 22, 2024 Sunday

Helio centric aspects for the next 3 days: Earth 150^ Pluto; till Dec. 24 ! it happened before between Feb 19-21.24 .After that, the S&P rallied ; so the year end rally is still ahead .IMHO

For today, the strongest planet is Venus (Banks, Forex) the weakest is the Moon at 23* Virgo.

I read, that a bomb blew off in central Stockholm..

Under Mars-Pluto opposition. It will not be the last one, under this very bad aspect.

TA35: my forecast posted during the week end was " I only look at the planetary positions. 2353 is a support, up targets: 2364-83" it is now 12:00 noon top so far 2384.18; now the stop is 2381.80, long above to 2384

closed at 2390.09

Tomorrow 2394-99 is still a target.

December 21, 2024, Saturday

General though about how to trade and what to expect: here is the Dow chart, as you can see, since April low, it always corrected down not more then 0.5- 0.23%- and later made new highs.

Taking Oct 27th low and adding 45 days, you can see the dates, they give more or less tops/bottom. Why 45 days? it's half of a square in the sky. These are calendar days; with trading days the dates will be different, depending on the country. (holidays change); but, since the planets don't know holidays, they just move as they do; we rely on calendar days.

I marked the last low in a blue table: and I wrote before, that if that low doesn't break, it is only a correction, as mild as it could be, but a reversal is possible, not only because of the upcoming X-mas rally, but also because the Moon moved out from Leo to Virgo, thus bringing in new energy.. The question is, will this energy be maintained, when the markets open on Monday ?

Let's look what else has happened that made the markets reverse?

1) Moon moved into Virgo

2) Venus 120^ Jupiter

In the Helio centric chart Venus in Taurus! ( rules) 90^ Pluto

and the outcome:

so, as you can see, the planetary position are in harmony with the Fibonacci levels.

USA: X-mas: Dec 24: early close; Dec. 25 - closed;

This means, for TA35: quite a vacuum, for 2-3 days; so the robots are loose.

Let's see what changes are in the sky till the end of the year?

Already tomorrow the Sun moves out of fire Sag- and enters earth Capricorn. till the end of the year it moves 10 deg.-1 deg/day.

The Moon moves from Virgo to Cap 22*- we will have the New Moon on the31st; 26 minutes after midnight...

Mercury will still be in SAG.9-19^

Venus moves in ♒17-27*

Mars moves in ♌R 4-1* also OOB;

the rest hardly move 1 degree or less.

Planetary Geo aspects for a month:

The next week Jupiter 90^Saturn- happens twice a year; we will check what happened previously ...

As of Jan 1-6 Mars 180^ Pluto - happens once a year..

Important ingresses: Mars enters Cancer; Mercury to Cap; Venus to Pisces. All these moves make a difference

let's see what happened before, when the SUN was in ♑?

The DOW has data since 1890- Based on the

Sun cycle: it shows a rally between 28 SAG to 17 CAP. - so as from Dec 19 to Jan 7th..

Is everything rallying during this period of time? you are welcome to subscribe to the forecasts and see how is YOUR share behaving under the upcoming planetary positions..

Here is a deeper analysis for the DOW with the planetary positions mentioned above:

The calculation is based on the last 100 years:

Jupiter 90 Saturn: happened before in 2015:

Venus in Pisces: from Jan 2,2025

The graph shows the rally from March 6, 2009 till now =

Result: 5769 days

It is 5769 days from the start date to the end date, but not including the end date.

Or 15 years, 9 months, 15 days excluding the end date.

Or 189 months, 15 days excluding the end date. This is the longest rally ever.. I can thing of 12 years cycle of Jupiter, the 29.45y cycle of Saturn; only Jupiter- Chiron has 15.48Y cycle in the Helio centric sky...

but TS shows, that this cycle doesn't work for the DOW:

the next planetary cycle is 19.86 years... Jupiter -Saturn...this works the best! Next upcoming aspect is Jupiter 90^ Saturn

Looking back to 2015 - in 8 days, under this aspect, the DOW fell: by $991.TA35: what I expect for tomorrow ? closed 2364.37; the arbitrage is positive; +0.35; not that I care... I only look at the planetary positions. 2353 is a support, up targets: 2364-83

~~~~~~~~~~

December 20, 2024 Friday

Yesterday in the USA:

the decline continued, lead by the Real Estate !

DIA: SPY: with former stop = 600 , now still short below 589.35 ( blocked by Saturn)

QQQ: is correcting the rally between Nov 15- Dec 16;

So, the question now is, will the break the last lows ?

Pls., subscribe to the forecasts, ( payment on Pay Pal - my mail is gabymitt@gmail.com)

only $126 for 3 months !!! to see what cycles are coming.

~~~~~~~~~~~~~~~~~~~

Back later.

Fear and Greed index - is in extreme fear.. time to check some buys... not overall, but shares that trade above 1 B - shares..

or

look only at the strongest shares ! Historical corrections :(thanks to Micha

So far in the S&P: and it's not over yet !

NASDAQ: not over yet !

December 19, 2024 Thursday A picture is better than 1000 words... Powell poured the baby with the water out... lol at 9 PM- 9:30 big sell off happened.

Markets often react to Federal Reserve Chair Jerome Powell's speeches based on how investors interpret his remarks about economic conditions, inflation, and monetary policy. Here are some reasons markets might fall following his speech:

1. Rate Cut Signals Caution, Not Confidence:

- Although Powell announced a rate cut, markets may interpret it as a sign that the Federal Reserve is concerned about underlying economic weaknesses rather than confident in robust growth.

2. Hawkish Undertones:

- If Powell mentioned that the Fed remains vigilant about inflation or emphasized that future rate hikes are still possible, markets could view this as a less dovish stance, dampening investor optimism.

3. Economic Data Uncertainty:

- Powell’s acknowledgment of potential risks, such as weaker global growth or ongoing challenges in specific sectors, might increase market volatility and sell-offs in riskier assets.

4. Profit-Taking:

- If markets had rallied in anticipation of Powell’s remarks, the decline could be due to profit-taking after the event, especially if the speech lacked groundbreaking updates or reassurance.

5. Broader Macro Concerns:

- Beyond Powell's speech, factors like geopolitical tensions, weak corporate earnings, or signs of slowing global trade could amplify negative reactions in the market.

Yesterday was a minor CIT day: 13 days from Dec. 5 -6 top; Stop in the ES was 6120; while in the spot 6000- as I posted in the Tlg. group.

In the sky, while Powell spoke, the Sun was conjunct the Galactic Center, happens once a year.. also see the other aspects..

What to expect today: It is a day ruled by Jupiter, which is weak in ♊and Mars, which is in R, in Leo; actually nothing much changed since yesterday - the Moon is still in Leo, usually the S&P makes a bottom or a top when in this sign. Now, seems it's a bottom- a correction; of the rally since Nov. 19: targeting 5922; falling below, I don't see a new ATH this year..

Next CIT days: Dec. 23,27,28,29.

Nasdaq: first support is at Dec 10 low; next :Nov 27th. BTC: looking at the Dec.10-17 time interval, the stop is 101390; falling below, next target 977600.

~~~~~~~~~~~~~~

ASIA and the Far East now: 8:30 am; only these are green.

Nikkei already closed; it is still in the channel- but fell below the mid-level- short below 38950.

Nifty: gapped down; probably it will try to close that gap within 1-3 days.

Europe futures : all in all we are in a correction phase.

~~~~~~~~~~~~~

Important planetary positions :

~~~~~~

I wrote about the DJI on 12/14th ! " DJI : 43000- below it, there is a gap to be closed to 42000; - the time tunnel called for a correction, it the calendar days 120; as well as in the trading days 89 days fib. no- wise. counting from Aug,5 low.. Did you make that excel table I am talking about>? You knew..

the DIA has been falling since 12/4 - it was the first to reverse... target 420 - to close the gap

A comparable decline occurred in early 2022. From January 5 to January 24, 2022, DIA fell from around $365 to $340, also a decrease of about 6%.

Early 2022 Decline (January 5–24, 2022)Context: This drop occurred as investors anticipated tighter monetary policy from the Federal Reserve to combat rising inflation. Concerns about an economic slowdown also weighed on sentiment.

Aftermath: The market experienced a short-lived recovery as investors priced in the Federal Reserve's actions.

However, volatility persisted throughout 2022 due to continued rate hikes a

and geopolitical tensions (e.g., the Russia-Ukraine conflict).

~~~~~~~~~~~~~~~

December 18, 2024 Wednesday:

Yesterday in the USA markets:

the weakest group was the industrials and the Financials! and this is bad... Banks carry the markets but when they are weak...

If you hold any bank shares, tighten stops!

~~~~~~~~~~

News in the sky:

The Sun moved 1 deg. since yesterday, now at 26.50♐;as per Ebertine this is the place of the Left hip veins. I look at these "medical" degrees because a lot of people are interested in them and suffer from different diseases, now that the Sun is in Sag and the ruler, Jupiter is weak in Gemini...The Sun today squares Neptune, which is at 27♓( Pisces27

Phalanges Of Right Foot, Acute Nephritis (Kidneys) ) and it is also the exaltation degree of Venus. Venus rules the banks and forex... and Neptune blurs everything, so look out for some "fishy" moves in the banks.. Neptune will be at 27* till Feb.2!.2025... so this is a serious and lasting issue! Medically, of course, I am not a doctor, and you should turn to a Medical dr. if you suffer from anything.. but the astrology gives a hint by all means. and of course, everything depends on your own natal chart

What else happens today? I already wrote, that the day is ruled by Mercury, so expect a zig-zag trade ! Mercury is at 6♐ ( Left

Large Femoral Artery, Anxiety ) the Antiscia ( mirror place) is at 23 ♑ which is linked to : Muscle

Endings From Upper To Lower Legs. ( sports, long walks are suggested...

Venus, at 12 ♒ rules Left

Crural Band ; For trade, it is 45^ to Neptune...and we are back to the banks ! the Antiscia of Venus is at 17♏ which triggers : Testicle

Lobes, Left Ovary .

Mars is at 5 Leo in R, (Right

Carotid Artery ) and the Antiscia is at 24 Taurus ( upper jaw).

Jupiter is at 14 Gemini R (Clavicle

(Collarbone) the Antiscia is at 15 Cancer ( Gastric

Nerves, Suicide ), this is odd, why did Ebertine link 15 Cancer to suicide> when we have two best fixed stars at 14.13 ~Sirius~ and 14.59 ~Canopus~? maybe because 15* Cancer is the exaltation degree of Jupiter? ! ? Jupiter is 150 to Juno today; that 's a bad position..

Saturn is constant at 13 Pisces; has been at this deg. since Dec 5 till Dec 24th !! 1:57PM ( GMT+2); it rules: Artery

Of Left Foot ; while the Antiscia is at 6 ♎Pubis;

Uranus at 23.50♉( Teeth

(Rheumatism) and the Antiscia: at 6*♌Entrance

Of Pulmonary Artery, Eyesight, Aselli ; will be at this degree till March 13, 25

Neptune at 27 Pis. till Feb 2,25

and Pluto: at 0 Aqua - till Dec. 30; Antiscia at 28 Sco (Mucous

Membranes )

~~~~~~~~~~December 17, 2024 Tuesday

Yesterday in the USA: we got a huge rally, after positive Fed., announcements, check out yesterday's post. Yesterday was also 60 days from Oct 17, 2024- which is half of Mercury synodic cycle. Yesterday the Moon was OOB - so very strong.. and you know the outcome.

But, what went up, must come down, sooner or later.. will it be today? a day ruled by by the Sun and Mars. So first we check where are they..

The Sun is at 25♐, in the last decanate of this sign. It is interesting, that since the Sun entered SAG, there are a lot of posts on FB about the liver ( biggest organ in human body), ( ruled by Jupiter biggest planet, ruler of this sign).Here are the parts of body in the sign of SAG:

But, back to the sky: so the 25th degree, as per N.S. teachings, is an Aries deg... therefore we have twice a fire position for the Sun.

Mars, is also in fire Leo, and Mercury, which is now Direct in motion, is also in fire SAG. So we have the background for this late rally.

The Moon, on the other hand, is in water Cancer, today's aspects:

17.12.2024 15:01:37 24°03'26"Cnc Sextile Uranus

17.12.2024 20:33:10 27°09'32"Cnc Trine Neptune

and tomorrow she will join the rest in Leo (fire). What happens tomorrow >?

these better be positive, and the road to X-mas rally is open..

The FED. int rate is already implemented, known...

Tomorrow is Wednesday, ruled by Mercury, so trades can go both directions... ! Keep tight stops.

~~~~~~~~~

Check out the Helio sky ! there is a nasty Mercury-Neptune position- during announcements !

OKEY.... now, it's 7:52 am; let's see what's happening in the world.

China, finally started to move, after "billions of injection into the market; but, it is still below the stop, I posted yesterday...

TSLA: have you seen the analysts ratings? I would fire all of them! 1 year price target 290 ? ha!!

an article about

Red Cat says, that it rallied.. OK, so I look at it's graph.. lol

Once it was 81370 - !!!!! $ now 10 !! wow..

Drone industry - agreement with PLTR.

In 20 years, fell from 81K to 10 $ - maybe in the next 20 years it will go back to 81K? who knows ?? lol In any case, it belongs to Technology, comp. hardware sector :

drones are in fashion now, so from 10 it might even go to 12-14 -20 ..

~~~~~~~~

everything that has "quantum" in it's name might rally now after GOOGL: so QUBT: once 500 - now ; tr range 7-22.

SPY: check out the lower highs !

pls. check out all the alerts I sent in my Telegram grp yesterday, and updated now.

~~~~~~~~~

The other day I uploaded the chart of Michael Sailor, saying what a genius he is ( MSTR ) now, I can add Michael Dell, who also has the famous Virgo stellium : Mars +Uranus +Pluto !

He is the 10th-richest person in the world as of December 2024, according to Forbes Bloomberg Billionaires Index, with a net worth of $130 billion. As of October 2023, according to Forbes, approximately $50 billion of his net worth was derived from his 50% stake in Dell and 40% stake in VMware, with the rest being held by his family office DFO Management.

In January 2013 it was announced that he had bid to take Dell Inc. private for $24.4 billion in the biggest management buyout since the Great Recession. Dell Inc. officially went private in October 2013.[4] The company once again went public in December 2018.[5]

(founder of Dell Technologies -

DELL in the channel:

December 16, 2024, Monday

My most beloved composer, Beethoven was born today, in 1770; 254 years later he still "lives" with us. A person is alive till he is remembered... is a proverb I cannot forget. The Hungarian Kodaly Zoltan was also born on this day, in 1822.

~~~~~~~

During the weekend, the BTC made a new sprint and made a new ATH:

The last uptrend started on Dec. 10; when the Sun was 45^ to Venus and Mercury 165^ to Uranus.

The trade range now is 104000 = stop ; targets: 106590-108140-110000.

News in the sky: we have the Moon, Ceres and the Sun OOB; the strongest is the Moon, while the weakest planet is Mars :

Mars is breaking away from an opposition to Venus, and is in R.- the Moon in Cancer, is strong, since it's a sign she rules. She is also departing from a disharmonious aspect to Pluto, and the Sun is 150^ (bad) aspect to Uranus. - this aspect happens twice a year.

Any announcements today ?

the outcome: positive, under good planetary aspects.

here are the planetary positions for 4:45 pm ( GMT+2) Mars 120^ Mercury- good aspect..

Splits: PAWN: if you have 1 share, you will have 2.

| Dec 20, 2024 | Tractor Supply (TSCO) | 5:1 |

| Dec 17, 2024 | 22nd Century (XXII) | 1:135 |

| Dec 16, 2024 | Palo Alto Networks (PANW) | 2:1 |

Futures now: are green

Markets:

Asia and the far east: now : 8:56 am only these are green, the rest are falling

Singapore made a new ATH ; long above 1760

China50 has been weak, still is, it's a short below 13714

Nifty: ran up for 6 months, now it makes lower highs, trade range 24045-24950

Nikkei: posted on 12/5: consolidating between 37500-40500.~ still is.

~~~~~~~~~~~~~

In Europe: DAX: like many other indices, bottomed on 8/5- it is after Fib.89 days; tighten stops to 20315;

CAC: the inner turmoil doesn't add to the country's economy, it has been falling since 5/15 ! it will be a big short below 7400.

UK FTSE: also topped on 5/15- but at least is trying to go above former tops:

~~~~~~~~~~~~~~

3:09 PM PREMARKET MOVERS:

Nasdaq 100 compared to MAGS' 7 +MSTR +PLTR in 2024

December 14, 2024 Saturday

Yesterday in the USA: we got a high opening, and a decline during the day:

The question now it, will the support levels hold?

DJI : 43000- below it, there is a gap to be closed to 42000; - the time tunnel called for a correction, it the calendar days 120; as well as in the trading days 89 days fib. no- wise. counting from Aug,5 low.. Did you make that excel table I am talking about>? You knew..

IXIC: it is still holding above the trendline, for swing trade it's a long above 19750; but, note the gaps!

S&P: although below the trendline, but, consolidating - so above 6030 it is still a long not only technically, but this is also a strong planetary support.

~~~~~~~~~~~~~~~~

News in the sky news week:

Planetary positions: most important is Mercury turning Direct on the 15th; Ceres is OOB and only the Moon moves from Gemini to Virgo.. We will have the Full Moon tomorrow at 11:00 am Tel Aviv time.. at 23♐

~~~~~~~

Looking at TA35: closed at 2335: at this level it is supported by Jupiter, which is weak and R; below it, next supports are: 2325-2313; the arbitrage is negative, so probably it will open low and correct up during the day.

~~~~~~~~~

News in the world:

Nancy Pelosi is in the news... some news say, Brian Thompson was going to testify against her, for inside trading, ( who knows ) - and the news links her to his killing, Other news say she broke her hip, and she is hospitalized, it is hard to know nowadays, when there are so many fake news. One thing is clear... Looking at her chart; there are 2 different birth hours in astro.com, one for 3:15 pm, the other is rectified to 2:30 pm; but either way, we see asteroid Pinocchio in her 8th house; No doubt money issues are "fishy" next , like everyone else at the age 84, she is under Uranus return, a mercy-less position. as per her age point, she is on her South Node; 20 Libra, and check out, how many asteroids, MP, are around 20 degrees! H2/8 MP !! one of them... points to money issues at this age.

Her H6 ( health open sunder Cap- ruler= Saturn, is at 0 Tauris, gets an exact square from tr. Pluto

Below is her natal chart, it would be too "crowded" if I added transits; but we know the planetary position: Saturn in tr at 13 Pisc, Uranus at 24 Taurus , Neptune at 29 Pisc and Pluto at 0 Aqua..

~~~~~~~~~~~~

Watch out for the upcoming splits !

PAWN: graph with last alerts.. it will be a long only if above 395.

December 13, 2024 Friday

Yesterday in the USA:

Biggest volume: money talks and B***S walks :

BURU: TR.range: 017- 2.30 not to mention, once it was 540!

Aspects for today, sent for subscribers on Dec. 1: NY time

UPST: BREAKOUT, TARGET 100-108

December 12, 2024 Thursday

Yesterday in the USA:

Rally, under

Communication: Group by market cap :

GOOGL: New ATH: ; stop is at 168; target 227

AAPL: first trade date today, in 1980: now there is tight trade: 242-252

Ran up to 411, it should go above 415- to be able to go higher!

TSLA: trade range 373-584 - should reach it by March 16.25

NVDA: is building a dangerous H&S pattern... trade range 135-147

~~~~~~~

News in the sky: once the Moon moved into Taurus, markets reversed !

ES:QQQ:

FUTURES: ARE RED

Today the Moon is closest to Earth, therefore strong, also exalted in Taurus..

~~~~~~~~~~~~~

Order now !! the forecasts... to see what will the next days/weeks bring. $126 for 3 months for anything you trade.

~~~~~~~~~~~~~~~

December 11, 2024 Wednesday

It is a day ruled by Mercury , which is at 8 ♐( a Sco. degree) and in R and Detriment - so by all means, weak. Since Mercury "brings the news" I checked if there are any Fed. announcements today : before USA opens: so probably markets will consolidate and wait for these outcome:

Aspects today: Mercury is 165^ to Uranus; Jupiter is 135^ to Pluto, both bad aspects.

Aspects of the Moon GMT+210.12.2024 1:58:41 6°06'34"Ari Trine Mars

10.12.2024 7:18:49 9°16'22"Ari Trine Mercury

10.12.2024 18:23:49 15°52'24"Ari Sextile Jupiter

11.12.2024 0:13:12 19°21'25"Ari Trine Sun

11.12.2024 17:54:48 0°00'00"Tau <<< exaltation

11.12.2024 18:43:01 0°29'07"Tau Square Pluto

12.12.2024 : Moon is closest to Earth, ( Perigee ) = strong

12.12.2024 15:27 13Tau 3 365383.560

12.12.2024 3:00:56 5°30'14"Tau Square Venus

12.12.2024 3:49:37 5°59'43"Tau Square Mars

12.12.2024 15:55:07 13°19'45"Tau Sextile Saturn

~~~~~~~~

Yesterday in the USA: Best group was the communication: Biggest volume:

GOOGL: posted yesterday: MSTR: posted yesterday on FB as well trade range is between 365-96; yesterday topped at 380 !

TSLA: CLOSED ABOVE 400 ! Trade range now is 400.68 - 408.35

Some cryptos I am in : and out of

BTC: 97500 is stop, should stay above it.ETH: stop was /is 3650

IOTA: DOGE: ~~~~~~~~~

Analyzing the natal chart of Michael Sailor, MSTR, and board meeting to buy BTC:

~~~~~~~December 10, 2024 Tuesday

It is a day ruled by Mars . It is stationary at 6 Leo; Mars bring energy, power, pushed the market up, usually, but it's in Retro, so, it's negative.

The main aspect for the next 3 days is a 45^ between the Sun/Venus

MSTR: take a different look at the share! First date date: June 11, 1998; Statistics for today : Decembers had more shorts than longs, Sun in SAG too and Moon , today in Aries too. actually it shows a rally only when the Moon is in Gemini...and why is that? Because the natal chart has Mars, Sun and Merc in that sign.

Posted on FB : 12/10

tr range 365-96

~~~~~~~~~~~~

Thanks to Anna-Cristal de Lyon, I got this data: Born May 6, 1998 - in Towson, MA- if born after 12, his Moon would be in opposition Brian Thompson's Moon at the 22 "kill or get killed degree.

Also L.M. Mars ( conj Sun) is at Brian Thompson' Sun/Jup MP..

Reason of shooting not yet known

Chart below : inner wheel: Luigi/ outer of Brian ( victim )

December 9, 2024 Monday

South Korea KRDOW: is the leader in the falls on this day:

On the other hand: these are rising

It's 8:48 am Europe is still waking up; futures:

In the sky: we have the Moon at 26*♓in occultation Neptune; and today we also have a certain Bayer Rule, that can point to a reversal within 3 days.

~~~~~~~

NY time: watch it when Moon enters Aries !

CIT: 89 days, from Sept 11, 2024 low ! in the S&P !

~~~~~~~~~~~~~

Seems, that Assad is alive and granted

asylum in Moscow ~~~~~~~~~~~

FTSE UK : DE40: posted on 12/5: it broke out; now : stop 20346

TA35: CLOSED AT 2362.38 - Ran up 20 points under Moon in Aries.

~~~~~~~~~~~

December 8, 2024 Sunday

Since Pluto will be now for 20 years in Aquarius, here is the area that ♒ "rules" on the globe:

Aquarius is a fixed air sign, ruled by Uranus and Saturn, so probably that pat of the world will see most uprisings, changes and new world order. Aquarius is in opposition ♌an area that falls between Hong Kong and Sydney, so the Plutonian effect will be felt there as well. Next, Aquarius Squares Taurus and Scorpio; so we have all the 4 elements involved, and of course areas in the world affected. Surely we must check each and every country to go down to details...

Checking the aspects the outer planets will make for the next 10 years:

News about ASSAD: seems he fled Syria, and his regime is over; some news state his plane crashed on its way to Qatar/Iran/.. not sure yet. For the county there are too many dates in WIKI to post, but

Bashar was born on 9/11/65 !! 9/11 of all dates.. He has a Sun 0 Pluto and Uranus in Virgo ( extreme cruelty for a doctor! "

he attended postgraduate studies at the Western Eye Hospital

in London, specializing in ophthalmology

.) . tr. Saturn conjunct natal Saturn ( Saturn return) - "time is up". We don't have his time of birth, so I don't use asteroids here..

Some thoughts about rectifying his chart: A rough correction of his hour of birth, putting his stellium to his age point 59.23; his Moon falls on the 22* ! and his H8 under Mercury(planes)... but that's just a thought, I didn't really worked on rectification. His brother died in a car accident, when tr. Uranus was in his 3rd house , on Jan 21.94; so I think using 10::52 am as birth would be fine..June 10, 2000: father died; tr.Sun+Venus conj. in H8 square his Sun.

July 17, 2000 : became president; under an inconjunct Uranus to his Sun ( H10 ruler)

On 7 December 2024, it was widely reported that Assad had fled the country as rebels took over Damascus during their lighting-quick campaign across Syria. Reuters claims two Syrian sources say that there is a high chance that Assad died in a plane crash.= Wikipedia

~~~~~~~~~~~

On this day in history:

Dec. 7, 1941 was the day pearl Harbor was bombed; and also when Assad fled/ crashed... interesting recurrence of events. ! Died on this day: R.I.P.

~~~~~~~~~ Nifty move stop to 24580:

NIKKEI: no change since a month : TA35: closed at 2343.9 - tomorrow's targets up to 57.

~~~~~~~~~~

December 7, 2024 Saturday

Looking into the next week:

The Sun moves from 16♐to23.45; so it will make a disharmonies aspect to Uranus;

The Moon moves from 12♓to 21♊next Sunday it will be the Full Moon.

Mercury is in Detriment and R; so weak twice; moves from 11 to 6♐; next Sunday it trine tr. Mars which is also R, but moves slower.

Venus at 1 ♒moves to 9*; it will trine the Nodes, which are at 3-2 Libra.

The rest merely move 1 deg.

We had an important planetary position yesterday: Jupiter was Perigee: Closest to Earth; next occurrence Jan 6, 2026; should mark some king of extreme; you can back check with your share, what happened around those days.

We also had

Mercury Perihelion ( distance to the Sun is Minimum, but this happens every 2-3 months; should affect the grains.

Yesterday:

A Retro Mars in Leo should affect mainly

the Gold: it mostly fellPls. order the forecast, to see into the future

In the Heliocentric sky we see, that Mercury leaves the sign it rules, Gemini and enters Cancer, where it is weaker..

watch the trend under the yellow aspects..

~~~~~~~~~~~~

Michael Sailor: no time of birth... however : clearly, an Aquarius genius ! Mars ( ruler of the date) conjunct Uranus and Pluto in H8 in Virgo! what a thorough explanation, clear cut and open of his way of thinking..!!!! WAWAWWWAAA

December 6, 2024 Friday

Premarket movers:

BTC: 60 min; stop and target on the graph

You can order the 3 months' forecast for $126.00

~~~~~~~~~~~

December 5, 2024 Thursday

Yesterday at 6:45 Brian Thompson CEO of Health care insurance was shot at the back, in the street, while he was heading to an investors conference; in NY. The shooter, masked, ran away on an electric bicycle.

Thanks to Maurice Fernandez, I received his data: born on July 10, 1974 in Iowa; the chart is a solar chart, in which we can see, Pluto in the H3( street)- got a conjunction from tr. NNode; 2) trChiron, the wounded healer, was in square his his Sun;

3) natal Moon at the kill or get killed 22 *

4) born under a solar eclipse on Betelgeuse, at 28 Gemini' got a disharmonius aspect from tr. Pluto, while it was at 28-30 Cap- so it was a prearranged killing.

5) I think Mars ( war, weapon, killing) in Leo ( important people, leaders, actors, managers Leo is the king of the jungle, after all) so this Mars in R in Leo, will kill a lot of high ranked people. In his case tr.Mars in H1 aspects Mercury+ Saturn ( both are ruler of H7+12) known and unknown enemies) and also sextile natal Pluto.

Since Mercury and Saturn are both in H12, I think 2 people were involved in this planned killing. Father and son? maybe ... time will tell. Did B.Thompson maltreat someone, and got a revenge.. maybe.. After all his Venus ( spite) is conjunct the SNode..

His Nodes are at 19* - that's age 49 - it was already planned more than a year ago. May he rest in peace.

Yesterday in the USA:

I posted yesterday my targets for the S&P- they were reached.. I see now the futures are higher.

The BTC: crossed $100K- top was 103620; which is a fib.targets from 56000 low, now, failing to go above 103620, it'll fall back to 90-80000; stop is now 102- target 107000.

~~~~~~~~~~

News in the sky:

The Moon moved into Aquarius, a sign, where the S&P tops/bottoms.

Mercury is "Combust" and in R - weak; Venus 60^ Neptune; Mars is stationary= strong, Saturn squares the Sun; ( happens 2 a year) ; Chiron at 19* karmic deg..

Market will start here in a Venus hour, with the Moon conjunct Pluto; will that bring a low expiry in the options today? Let's see.

~~~~~~~~~~~~~

expiry was 2326.18 - Gann target from 2024 low is 2328... so.. not much..

~~~~~~~~~~~~

As for the S&P:

Gann square from April 2024 low:

Nifty with my last alert, and now:

Nikkei is consolidating between 37500-40500.

SSEC: HAS THE BIGGEST VOLUME:

EUROPE: best performers in a week:

DAX: new ATH : stop and tgt on the graph

SEDOW: also made AN ATH, stop 1657- target 1725

~~~~~~~~~~~

December 4, 2024 Wednesday

Yesterday in the USA:

Yesterday, there was

a half day of

"martial law" that

backfired... announced in South Korea..

Looking at South Korea's chart ( made for noon)

I am astonished to find out, that their Asc. is on mine... no wonder, I am hooked with S.Korean serials for the last 2 years.. However, after a few hours it was over, but not done, because that transit Mars will linger there till Feb.- May. 2025. You see, Mars went R at 6 Leo- it will take till May 1st, to reach again that degree.

~~~~~~~~~~

here is the Solar chart for his wife, who is 52 years old and now tr. Pluto is in trine her age point

Their index is in a short for a long time now.. I read many are invested in XRP; and trade was halted for a while..

XRP: rallied since Nov 26 by 122%- stop is = 2.45

ְְְְְְ~~~~~~~~~

Today we are ruled by Mercury and Venus. Mercury is in R, at 16♐in exact opposition to Jupiter at 16, both are weak, being in Detriment and in mutual reception.(in each other's sign). The Moon is at 17♑, departing from the Sun and Mercury. Venus is at 26♑in a sextile to Neptune! Neptune is stationary, before turning D.

Futures now:

Looking at the S&P from April low, target on the Gann wheel is 6066-88.

~~~~~~~~~~~~~~~~

AMZN: STOP 225- LONG

AAPL: RALLIES! 241-244.

GOOGL: 171-178

TSLA: 350-53

NFLX: SHORT below 903

NVDA:

META: LONG ABOVE 612

December 3, 2024 Tuesday

The market opened with some enthusiasm yesterday but closed lower... obviously intraday traders sold

NAS100: double topped,

Communication group lead the rise:

Biggest market cap in the group :

SNAIL: market cap 52.8M - usually I wouldn't look at "small" companies; but this one is interesting !! Long above 1.30

GEO aspects for today: Jupiter 120 Vesta 3.12.2024 2:14

Moon 90 S.Node 3.12.2024 6:44

Moon 90 Node 3.12.2024 6:44

Moon 150 Mars 3.12.2024 10:30 = now

Moon 135 Uranus 3.12.2024 16:57

Moon 60 Saturn 3.12.2024 23:16

Helio aspects :

Mercury 0 Uranus 3.12.2024 3:04 - a new synodic cycle starts...

Mercury 120 Vesta 3.12.2024 7:08

Venus 90 Mars 3.12.2024 9:13

Mercury 60 Neptune 3.12.2024 16:51

~~~~~~~~~~~~

You can see the asteroids, that Merc-Uranus cycle starts. the trine Vesta and sextile Karma. Mercury stands for words spoken, might be Karmatic... while Uranus brings sudden , unforeseen event. They are in the fixed sign of Taurus; so if I take them as two people, none will budge... or suddenly become flexible..

We can add to that the Moon's Capricorn ( gov) position.

~~~~~~~~~~~

December 2, 2024 Monday:

GABY

ReplyDeleteGOOD MORNING from Desert USA

HAPPY HANUKKAH , I BELIEVE IT STARTS TODAY

i was trying to read your post on michael saylor which you mentined starts down but it only shows the chart which shows he has amassed lots of Bitcoins which is worth a lot

is anything i am missing???

merry christmas and have a Happy , healthy , peaceful, prosperous New Year to you !!!

vick